Abstract

Plum agriculture in Japan has seen fluctuating trends in harvest yields, bearing tree areas, and shipping volumes. Historically, the national harvest volume peaked in the mid-20th century but has gradually declined due to aging farmers and reduced cultivation areas. As of 2022, the national harvest reached 18.8kt, with a bearing tree area of 2.65kha, reflecting ongoing challenges in sustaining production. Yamanashi, known for its quality plums, led shipping volumes at 5.59kt, highlighting its strong market presence. Efforts to modernize cultivation and promote regional branding aim to stabilize production and adapt to changing consumer preferences.

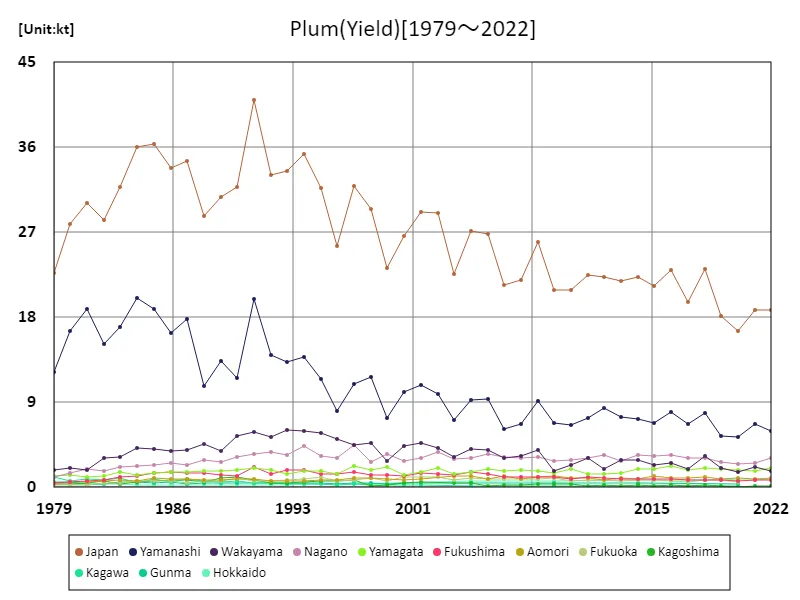

Plum harvest volume (main data).

Plum harvest yields in Japan have seen significant declines over the decades. The national harvest peaked in 1991 at 41kt, driven by robust demand and widespread cultivation. However, by 2022, yields had dropped to 18.8kt, just 45.9% of the peak. This decline reflects challenges such as an aging agricultural workforce, shrinking cultivation areas, and changing consumer preferences. Despite this, regions like Yamanashi maintain strong production and branding, contributing significantly to the market. Efforts to counter these trends include improved cultivation techniques, diversification of plum products, and promotional campaigns emphasizing regional specialties.

The maximum is 41kt[1991] of Japan, and the current value is about 45.9%

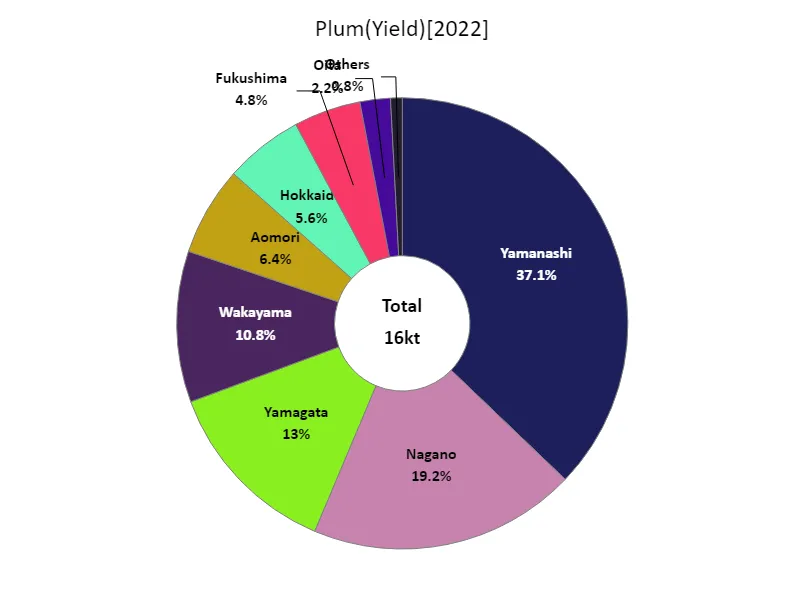

Plum harvest volume (by prefecture).

Plum harvest yields in Japan vary significantly by region, with Yamanashi consistently leading production. In 2022, Yamanashi recorded the highest yield at 5.94kt, showcasing its dominance in the market. Nationwide, however, plum yields have declined from their 1991 peak of 41kt to 18.8kt in 2022, reflecting broader challenges in Japanese agriculture, such as declining tree areas and an aging farming population. Despite this, regions like Yamanashi have maintained high output through advanced cultivation techniques and strong branding. Efforts to revitalize the industry focus on regional differentiation, value-added products, and sustainable farming practices.

The maximum is 5.94kt of Yamanashi, the average is 1.78kt, and the total is 16kt

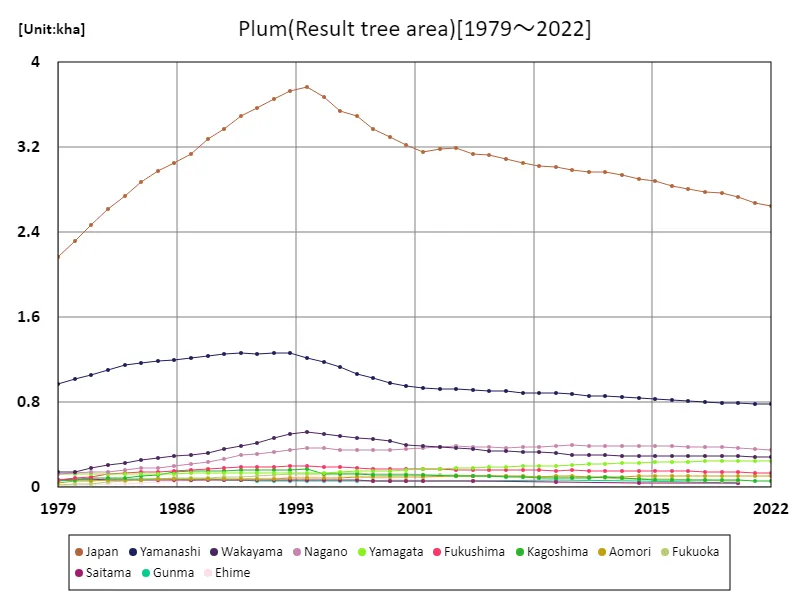

Plum bearing tree area (main data).

The area of fruiting plum trees in Japan has been steadily declining since its peak of 3.77kha in 1994. By 2022, this figure had dropped to 2.65kha, representing 70.3% of the peak level. This decrease reflects broader trends in Japanese agriculture, including an aging farmer population, reduced profitability, and shifts in land use. Despite the decline, key production areas like Yamanashi have maintained significant tree coverage through investment in efficient cultivation and promotion of regional plum varieties. Revitalization efforts include introducing disease-resistant strains and diversifying uses for plums to boost demand and ensure sustainable tree management.

The maximum is 3.77kha[1994] of Japan, and the current value is about 70.3%

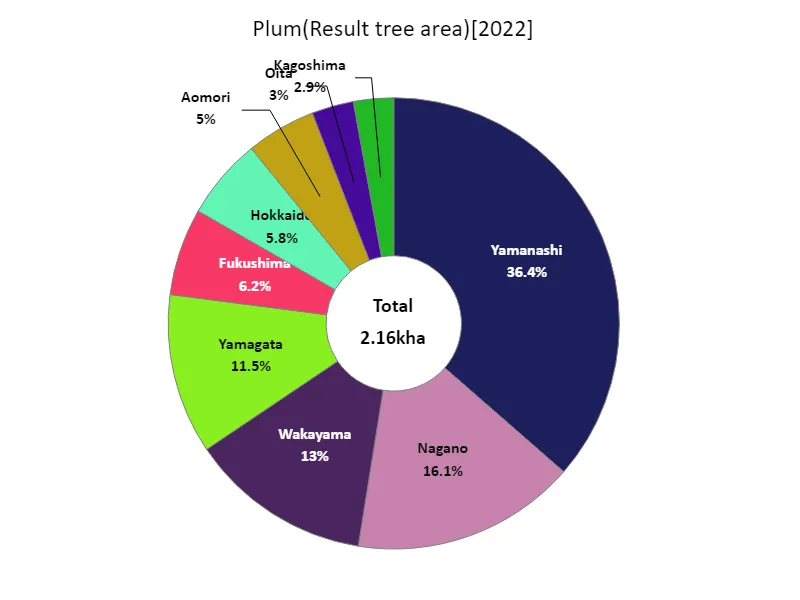

Fruiting area of plum trees (by prefecture).

In 2022, Yamanashi had the largest fruiting area of plum trees in Japan, covering 787ha, highlighting its dominance in plum production. While Yamanashi continues to lead, the nationwide fruiting area has declined significantly over the decades, dropping from its peak of 3.77kha in 1994 to 2.65kha, reflecting shifts in agricultural practices, aging farmers, and changing consumer demands. Regions like Yamanashi have sustained their leading position by leveraging advanced farming methods, regional branding, and promoting high-quality plum varieties. Nationwide, efforts focus on revitalizing cultivation through innovation and diversification to counter the long-term decline.

The maximum is 787ha of Yamanashi, the average is 240ha, and the total is 2.16kha

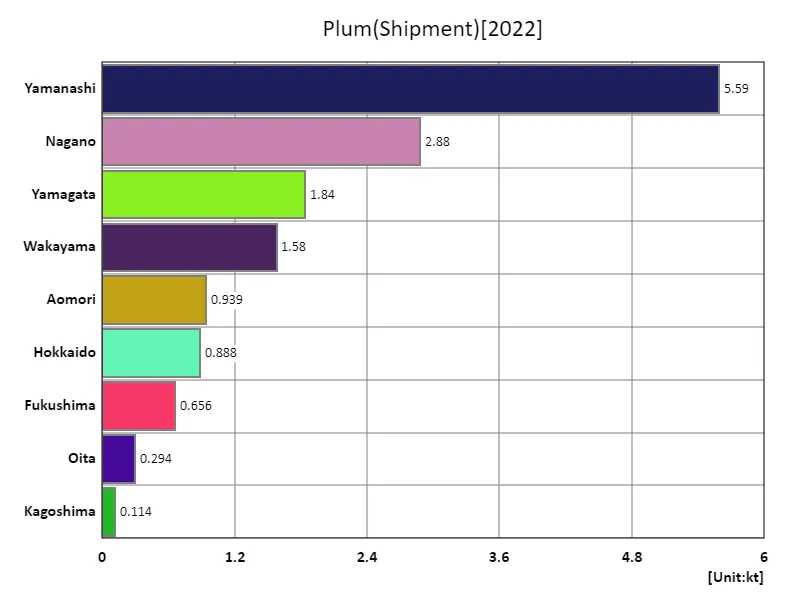

Plum shipping volume.

In 2022, Japan’s plum shipments totaled 14.8kt, with Yamanashi leading at 5.59kt, well above the national average of 1.64kt. This dominance reflects Yamanashi’s strong cultivation techniques, favorable climate, and effective regional branding. However, nationwide shipment volumes have declined over the decades, mirroring reductions in harvest yields and fruiting tree areas. This trend is driven by factors such as an aging farming population and changing consumer preferences. Despite these challenges, regions like Yamanashi have sustained robust shipments by focusing on quality and market differentiation. Efforts to stabilize shipments include promoting regional specialties and developing new uses for plums.

The maximum is 5.59kt of Yamanashi, the average is 1.64kt, and the total is 14.8kt

Comments