Abstract

In Japanese agriculture, domestic production of edamame in 2022 reached up to 10.5 kt, showcasing robust local cultivation. Conversely, green bean imports for the same year were relatively modest at 300 tons. Notably, green beans constituted a mere 4.5% of the total supply, reflecting Japan’s strong emphasis on domestic production over imports. This trend highlights a stable and self-reliant agricultural sector for beans, with a limited reliance on foreign sources despite increasing global trade.

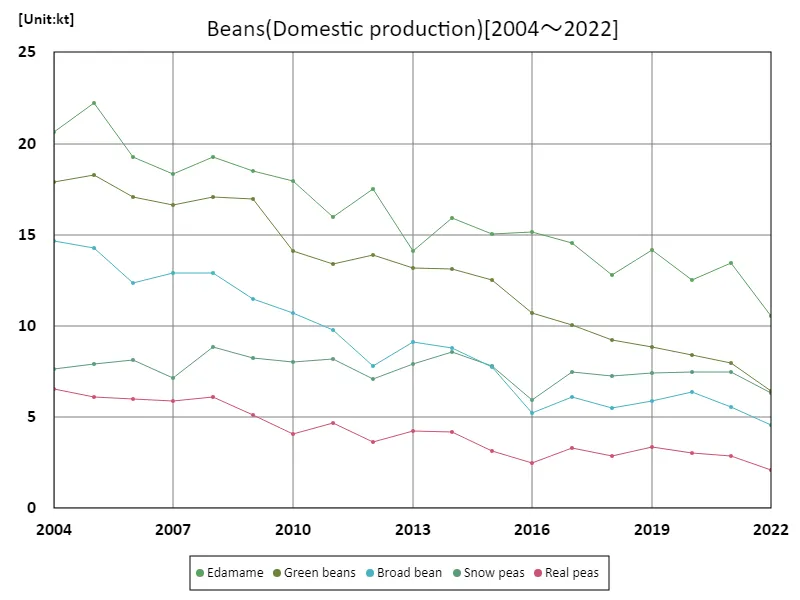

Domestic production of pulses

Japanese edamame production has seen notable fluctuations since 2004. The peak was in 2005, with a record 22.2 kt. As of the latest data, production stands at 47.4% of that peak, indicating a significant decline from historical highs. This reduction suggests shifts in agricultural practices or market dynamics, though edamame remains a key crop. Despite this drop, the crop’s enduring popularity reflects its continued importance in Japanese agriculture, albeit at reduced levels compared to its peak.

The maximum is 22.2kt[2005] of Edamame, and the current value is about 47.4%

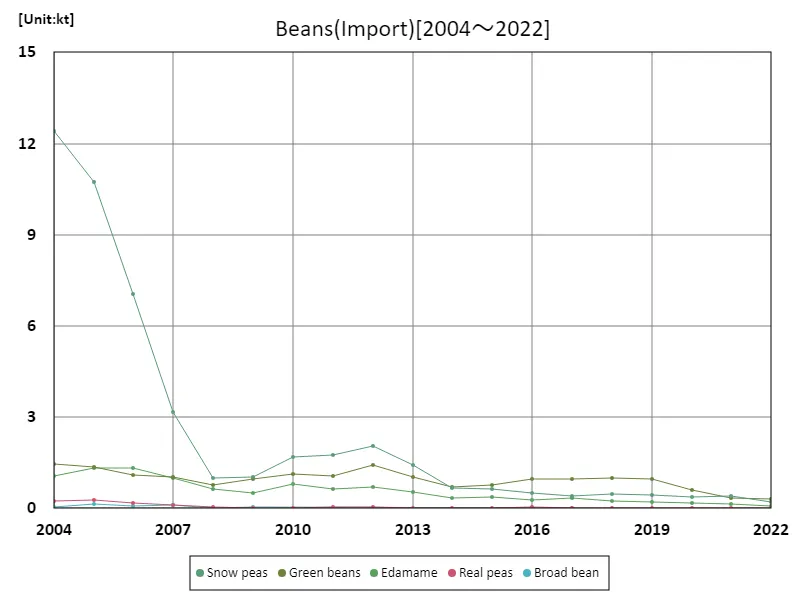

Import volume of pulses

In 2022, Japan’s vegetable import data highlighted Sayaendo as the top import, reaching a peak of 12.4 kt. This figure represents the highest market value for vegetable imports recorded in recent data. Sayaendo’s prominence underscores its significant role in Japan’s vegetable supply chain, reflecting growing demand for this particular vegetable. The trend indicates a continued reliance on imports to meet domestic consumption needs, showcasing the evolving landscape of Japan’s agricultural market where imported vegetables play a crucial role in supplementing local production.

The maximum is 12.4kt[2004] of Snow peas, and the current value is about 1.75%

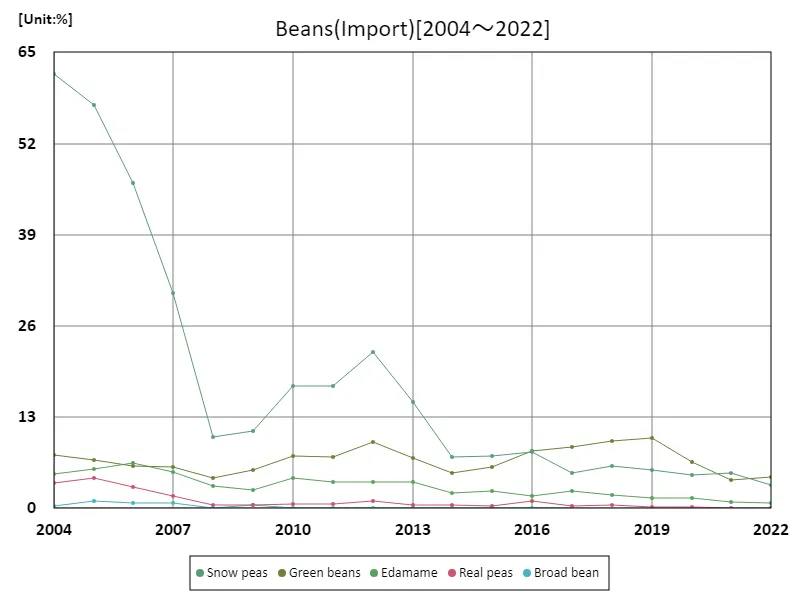

Import (percentage) quantity of pulses

Since 2004, the proportion of imported snow peas in Japan peaked at 61.9%. Currently, this figure has decreased by 5.33%, indicating a decline in the reliance on imported snow peas. This trend suggests a gradual increase in domestic production or a shift in consumer preferences and sourcing strategies. Despite the decrease, imported snow peas still play a significant role in the market, reflecting ongoing international trade dynamics and Japan’s need to balance between local production and imports to meet consumer demand.

The maximum is 61.9%[2004] of Snow peas, and the current value is about 5.33%

Comments