- Abstract

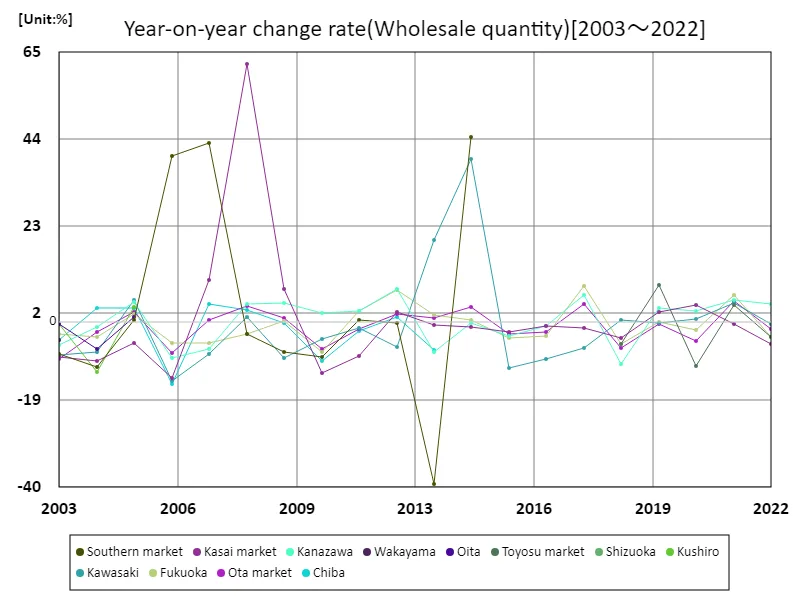

- The rate of increase/decrease in fruit compared to the previous year (wholesale quantity)

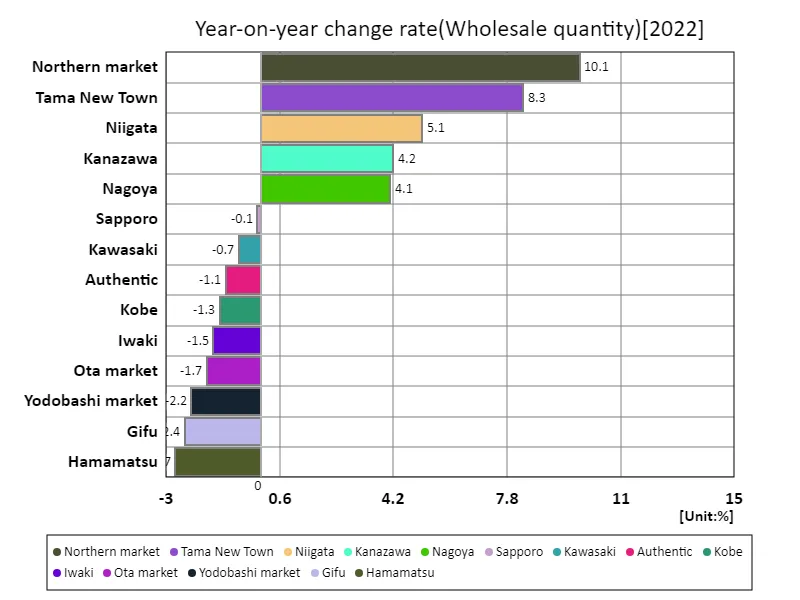

- Latest year-on-year increase/decrease rate of fruit (wholesale quantity)

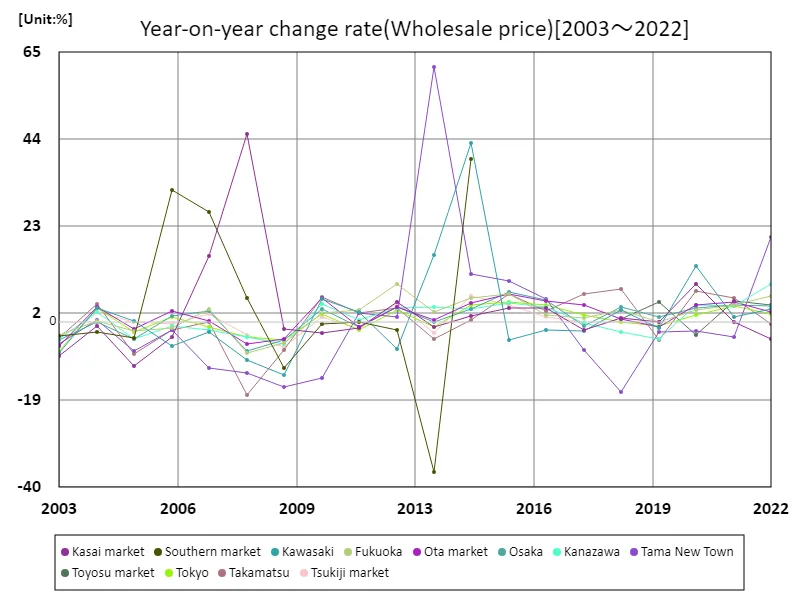

- The percentage increase or decrease in fruit prices compared to the previous year (wholesale price)

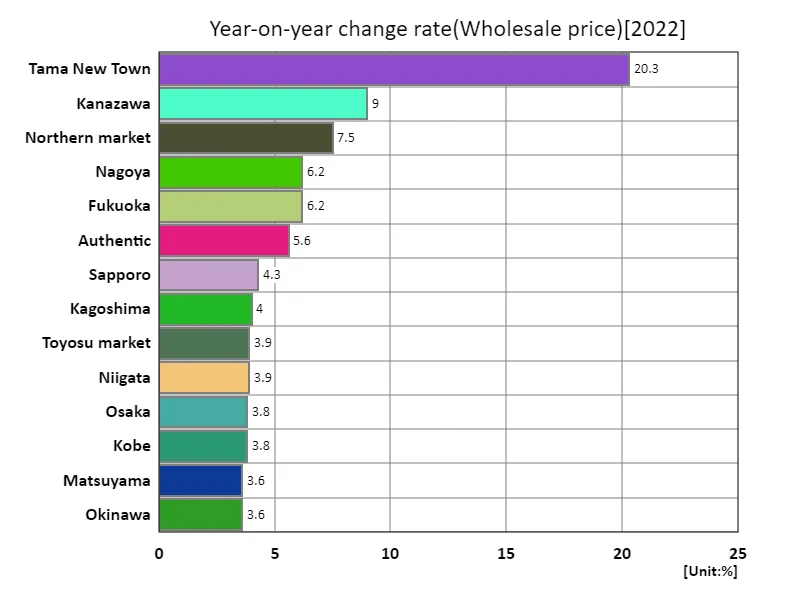

- Latest year-on-year increase/decrease rate of fruit (wholesale price)

- Reference

Abstract

Looking at the trends in imported fruit in Japanese agriculture, data from December 2022 shows that the volume of imported fruit was 22.3 kt and the value was 5.99 million yen. This indicates that demand for imported fruit remains high in the Japanese market. On the other hand, the price is 2,900 yen per kg, which is relatively high. This high price may be due to the demand for high-quality imported fruit and the costs associated with importing it. Past trends suggest that Japanese consumers have a high demand for high quality and wide variety of fruit, and import volumes are increasing in response. In addition, with the prices of imported fruit remaining at high levels, competition in the market is fierce and there is a demand for high added-value quality and brands.

The rate of increase/decrease in fruit compared to the previous year (wholesale quantity)

At Japan’s central agricultural fruit wholesaler, the volume of fruit imported has been changing since 2006. At its peak in May 2006, it recorded 89.7kt, but has since declined and is currently at 62.8% of that figure. This trend is thought to be due to factors such as changes in domestic fruit production and demand, as well as the impact of import policies. Additionally, the decline in imported fruit may be related to improved quality and increased demand for domestically produced fruit. One notable feature so far is the increasing competitiveness of domestically produced fruit. Furthermore, with growing concern about the environment and safety, consumers are showing a tendency to prefer safe, high-quality domestically produced fruit. This may be reducing demand for imported fruit. Demand for domestically produced fruit is expected to continue to grow, leading to increased competition with imported fruit.

The maximum is 62.2%[2008] of Kasai market, and the current value is about -8.84%

Latest year-on-year increase/decrease rate of fruit (wholesale quantity)

Looking at data by prefecture as of December 2022, the value of fruit in Japanese agriculture was highest for other domestically produced fruits at 17.5 million yen. This suggests that demand for other domestically produced fruits is growing in the Japanese market. This trend is thought to be due to regional characteristics resulting from differences in climate and cultivation environments from region to region, as well as changes in consumer preferences. Additionally, increased consumer interest in domestically produced fruits and increased added value due to improved quality may also be contributing to the increase in prices. One notable feature so far is that domestically produced fruit has been highly rated in the market and demand for it is increasing. Furthermore, it is believed to be linked to the promotion of local industries and the development of local brands. As consumers continue to become more health-conscious and interested in quality, it is expected that demand for domestically produced fruit will continue to expand and prices will continue to rise.

The maximum is 10.1% of Northern market, the average is -4.86%, and the total is -233%

The percentage increase or decrease in fruit prices compared to the previous year (wholesale price)

The price of imported fruit for Japan’s agricultural sector peaked at 4,270 yen/kg in April 2006, but has since declined, currently standing at 67.9% of the peak. This trend is thought to be influenced by fluctuations in global agricultural product markets, transportation costs, and changes in exchange rates. Additionally, competition from domestically produced fruit and changes in consumer values also affect price trends. One notable feature so far is that imported fruit prices were stable for a certain period of time, but have since peaked and are now showing a downward trend. Another possible reason for this is that while the prices of imported fruit are falling, demand for domestically produced fruit is increasing. In the future, while the prices of imported fruit are expected to stabilize, demands for quality and safety are expected to increase. Therefore, the import fruit industry will need to focus on maintaining its competitiveness and increasing added value.

The maximum is 61.4%[2013] of Tama New Town, and the current value is about 33.1%

Latest year-on-year increase/decrease rate of fruit (wholesale price)

The maximum is 20.3% of Tama New Town, the average is 1.03%, and the total is 49.4%

Comments