Abstract

According to 2021 data, China is the largest importer of meat, with imports reaching 11Mt. Historically, China’s meat imports have been increasing rapidly. The main factor behind this is the rapid increase in demand for meat due to the country’s economic growth and urbanization. In particular, demand for pork and beef is particularly pronounced, which has led to domestic supply shortages and increased reliance on imports. Additionally, the increase in imports is also due to a temporary decrease in domestic production in China caused by livestock diseases such as African swine fever. Furthermore, from the perspective of food security, the Chinese government is pursuing policies to diversify supply sources and increase the number of trading partners. As China’s meat consumption continues to increase, import volumes are likely to expand further in the future, but are expected to fluctuate depending on food security and international market trends.

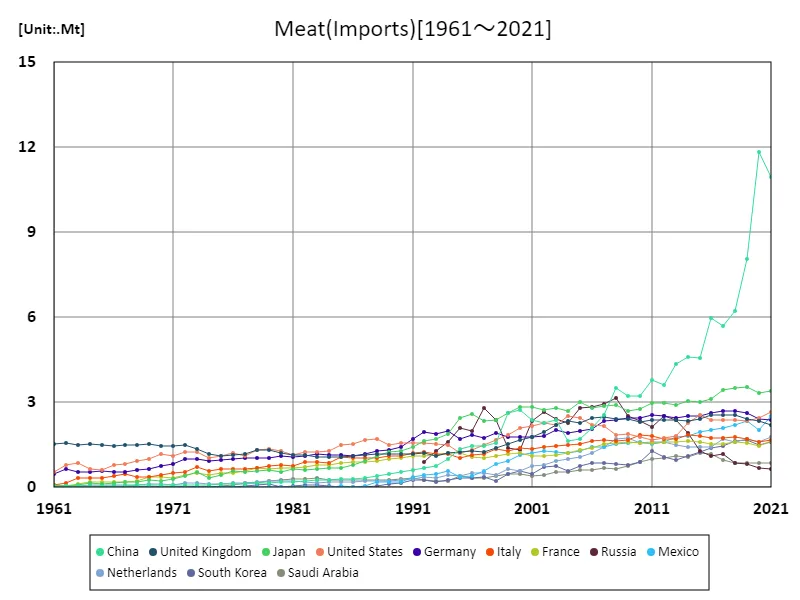

Meat import volume (worldwide)

Looking at data from 1961 to 2021, global meat imports have changed significantly. China in particular reached a peak of 11.8Mt in 2020, followed by a 92.7% increase in 2021. This reflects increasing demand due to changes in China’s eating habits and economic growth. In the 1960s, many countries mainly consumed meat that they produced themselves, but in recent years, international trade has increased and meat imports have increased. The case of China shows that rapid urbanization and rising living standards have led to a surge in meat consumption, which has resulted in a large increase in imports. On the other hand, a decline in imports from their peak suggests increased domestic production or a change in trade policy. Overall, it can be seen that meat imports are sensitive to economic growth and changes in food culture, and are significantly influenced by global market trends.

The maximum is 11.8Mt[2020] of China, and the current value is about 92.7%

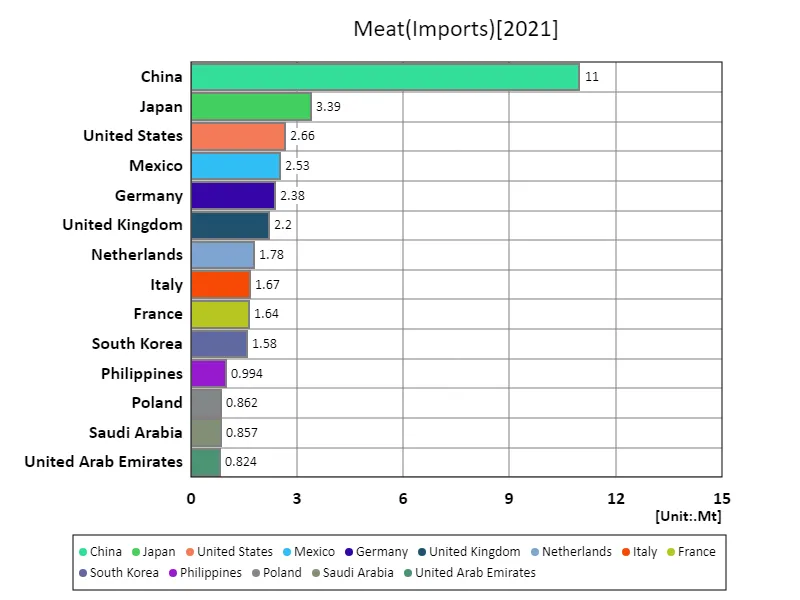

Meat imports (latest year, countries around the world)

Based on data from 2021, global crop meat imports show notable features and trends. China’s annual imports of 11Mt accounted for the largest share of all imports, highlighting the scale of China’s meat demand and its international influence. China’s large imports are due to rapid economic growth and changing dietary habits, which are the main drivers of demand in international markets. Global crop meat imports in 2021 totaled 53.7Mt, with an average import volume of 292kt. The data highlights the diversity of global food trade and the significant influence that major importing countries have on markets. In particular, developed and emerging countries tend to import in large quantities, which has a significant impact on prices and supply chains in the international market. Historically, agricultural meat import volumes have fluctuated due to economic developments, changing diets, and trade policies. For example, in countries experiencing rapid economic growth, meat imports tend to increase as meat consumption increases. Meanwhile, major producing and exporting countries also play an important role in regulating supplies and prices in the international market. Overall, agricultural meat imports are a significant part of international economic activity, with demand from major consuming countries continuing to have a major impact on global markets.

The maximum is 11Mt of China, the average is 293kt, and the total is 53.6Mt

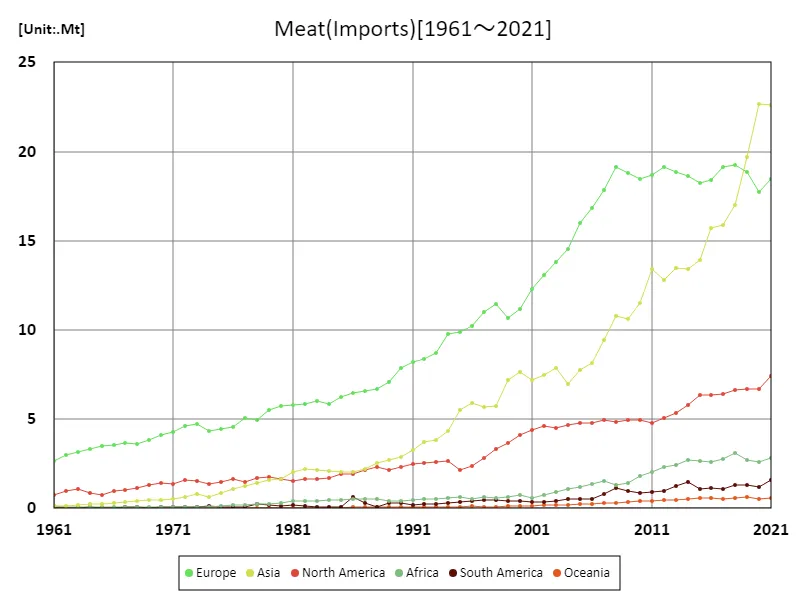

Meat imports (continent)

According to 2021 data, global crop meat imports totaled 22.7Mt, with Asia accounting for the largest volume of imports. The current peak in imports from the region indicates the important role Asian markets play in global livestock trade. Asia’s growing agricultural meat imports are driven by rapid economic growth, urbanization and changing diets. Demand for meat is increasing, especially in China, India and Southeast Asian countries, which is having a major impact on international trade trends. Rising incomes and a growing middle class in these countries are driving increased meat consumption, resulting in a surge in imports. Over the past few decades, Asia has emerged as the global agricultural meat market centre. Imports from Asia have been steadily increasing from the 1960s to the present, and this trend is expected to continue. This is due to changes in Asia’s food culture and economic structure, as well as the expansion of international trade. Overall, Asia’s growing agri-meat imports reflect changes in global food supply chains, and as regional economies develop, they have become an important component of international trade. This trend will continue to draw attention to the balance between food demand and supply in Asia.

The maximum is 22.7Mt[2020] of Asia, and the current value is about 99.6%

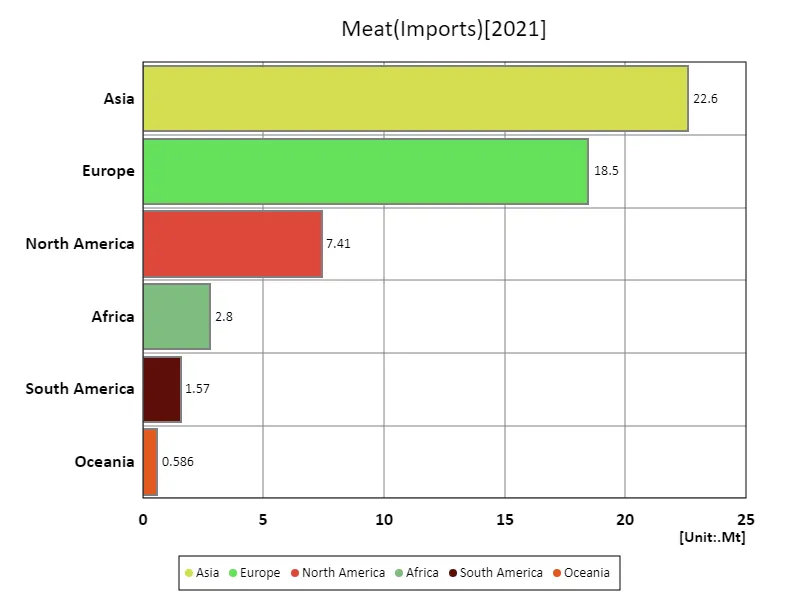

Meat import volume (latest year, continental)

According to 2021 data, global crop meat imports totaled 53.4Mt, with the Asia region recording the largest imports at 22.6Mt. Asia’s high import volumes reflect a surge in meat demand driven by economic growth and increasing urbanization. In particular, in China, India and Southeast Asian countries, changes in eating habits and rising incomes are driving increased meat consumption, which in turn is driving increased meat imports. Compared to other regions, Asia’s imports are significantly higher, with an average import volume of 8.91 Mt. This indicates that Asia plays a key role in the global farm meat market. Over the past few decades, Asia’s import volumes have been steadily increasing, which, combined with the region’s economic growth, has had a major impact on international trade trends. A defining feature of Asia to date has been the rise in food demand in line with rapid economic development, making the region a central player in the international trade market. Additionally, global import volumes are consistently on the rise, creating fluctuations in supply chains and pricing. Rising Asian imports are proving to be a key factor in the balance of supply and demand in global markets.

The maximum is 22.6Mt of Asia, the average is 8.91Mt, and the total is 53.4Mt

Comments