Abstract

New Zealand is known as the largest exporter of butter, recording 401kt in 2021 data. This demonstrates that New Zealand’s dairy industry has a strong presence in international markets. New Zealand’s agriculture is supported by a rich natural environment and efficient production systems, and dairy cow breeding is particularly thriving. The country’s butter exports have remained stable and high, remaining competitive in the global market. Other major exporters include European Union countries, especially the Netherlands and Ireland, which also have large dairy production. Butter export trends are subject to fluctuations in demand and supply, the impacts of climate change and changes in trade policies, meaning New Zealand needs to be particularly sensitive and adaptable in its markets.

Butter exports (worldwide)

Looking back at butter export data from 1961 to 2021, New Zealand has long been a leading exporter. In 2014, exports reached 537kt, making China the world’s largest exporter. However, export volumes have declined in the following years, settling in 2021 at around 74.7% of the peak level. This decrease may be due to an increase in domestic demand, increased competition in international markets, or fluctuations in production costs. While New Zealand’s butter industry continues to provide a high-quality dairy product, the decline in export volumes reflects the rise of other countries and changes in global markets. Going forward, flexible responses to agricultural policies and international market trends will be required.

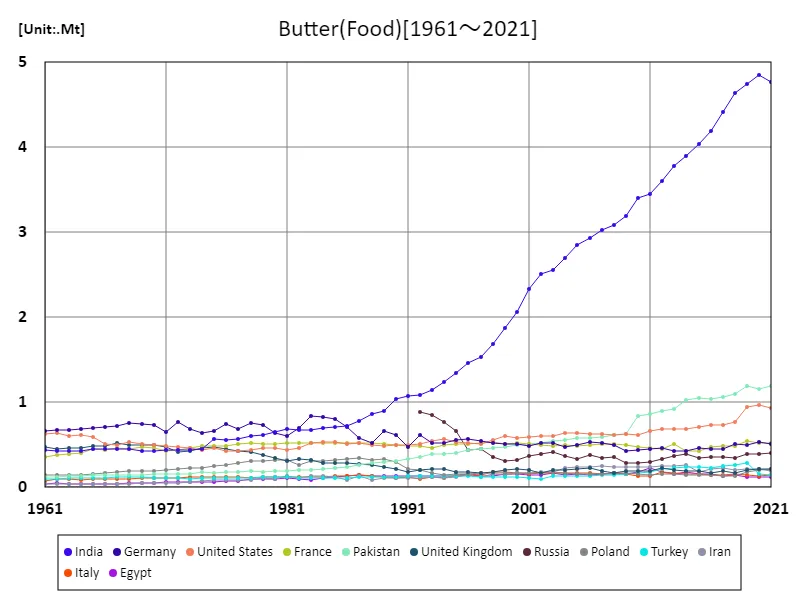

The maximum is 4.85Mt[2020] of India, and the current value is about 98.3%

Butter exports by country (latest year)

Looking at butter export data for 2021, New Zealand was the largest exporter, recording 401kt. This demonstrates New Zealand’s strong dairy industry and its international influence. Meanwhile, total world exports of butter stood at 1.99Mt with an average export volume of 14.9kt. This data highlights the large proportion of the market that New Zealand represents. Globally, butter export volumes remain stable, with major exporters including New Zealand and European Union countries, particularly the Netherlands and Ireland. With New Zealand’s exports accounting for around 20% of the total, its influence is crucial. In international markets, fluctuations in demand and changes in production costs affect export volumes, requiring strategic adjustments to respond.

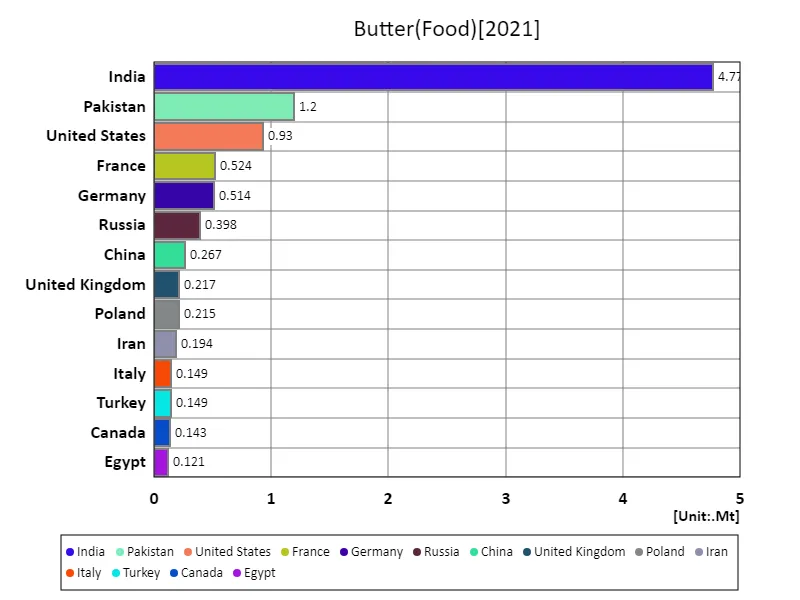

The maximum is 4.77Mt of India, the average is 66.5kt, and the total is 12.2Mt

Butter exports (continental)

Butter export data for 2021 shows Europe as a whole recorded the highest export volume at 1.56Mt. This demonstrates the strength of the European dairy industry and its importance on the international market. Over the past few decades, Europe has been known as a stable source of butter, with countries such as the Netherlands and Ireland emerging as major exporters. The increase in European butter exports is a result of efficient production, good quality and increasing global demand. In particular, improvements in dairy product quality control and production technology have contributed to maintaining competitiveness. Diversifying demand in international markets and changing consumer tastes are also having an impact. For example, growing health consciousness and the spread of new recipes are some of the factors driving demand for butter. European export volumes have remained stable, primarily driven by market demand for high-quality butter, and will need to remain competitive and adapt to market changes. The international butter market is dynamic and Europe will continue to play an important role in it.

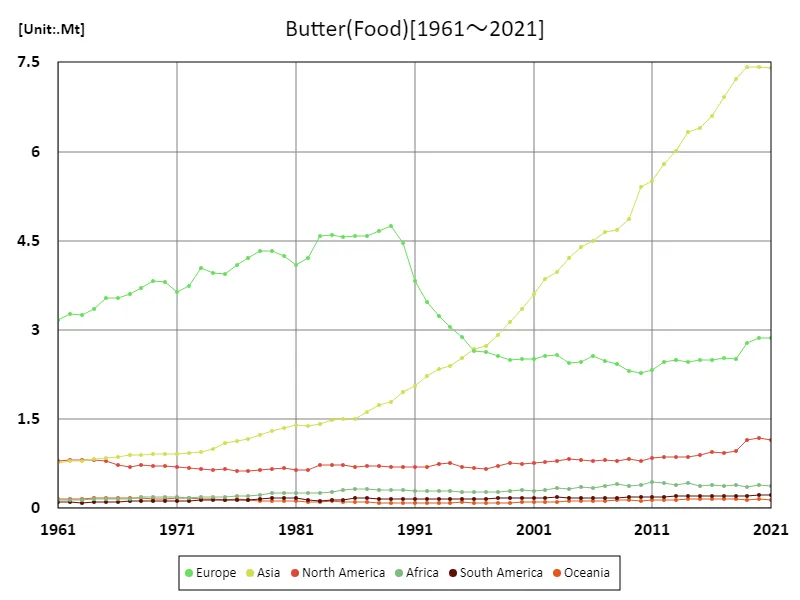

The maximum is 7.42Mt[2020] of Asia, and the current value is about 99.8%

Butter exports (latest year, continental)

Butter export data for 2021 shows Europe was the largest exporting region with 1.4Mt. This reflects the European dairy industry’s dominant presence on the world market. Overall exports totaled 1.99Mt, with Europe accounting for the majority of the market. The average export volume was 332kt, indicating its stability as a major exporter. Historically, Europe has focused on producing and exporting high-quality butter, and the data shows that this strategy is working. In particular, major exporting countries include the Netherlands and Ireland, and their efficient production systems and high level of quality control are the source of their competitiveness. In addition, the European butter market is flexible in adapting to fluctuations in international demand and changing consumer preferences, which is one of the factors supporting stable export volumes. Going forward, European butter exports are expected to maintain their leadership in the international market through quality improvements and strategic adjustments to market needs.

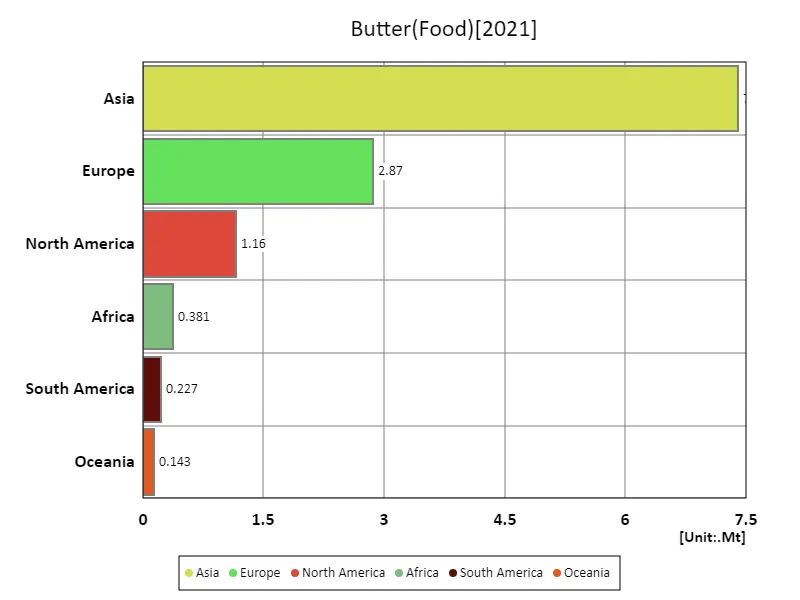

The maximum is 7.4Mt of Asia, the average is 2.03Mt, and the total is 12.2Mt

Comments